Chicago De Novo Bank Set to Open Second Branch on News of Third Quarter Profitability

Wealth Management

Signature Bank Expands With Downtown Chicago Branch

Chicago De Novo Bank Opens Second Branch in Chicago Loop

Signature Bank Celebrates Grand Opening of Chicago Headquarters Branch with Open House

New Chicago Bank Officially Opens Doors to the Public with Special Offers and Festival Activities for Community on Saturday, October 21, 2006

Strategic Asset Allocation: A 3-to-5-Year Perspective of Markets

George Smith | Portfolio Strategist

Additional content provided by John Lohse, Sr. Analyst, Research.

This year, investors encounter a unique array of challenges and opportunities within the financial markets. LPL Research’s recently updated Strategic Asset Allocation (SAA) and Capital Market Assumptions (CMA) offer valuable insights for navigating this environment. The SAA was developed through an analytical combination of mind and machine that incorporates quantitative modeling with team-based input and overlay from LPL’s Strategic and Tactical Asset Allocation Committee (STAAC). We explore LPL’s strategic views on equities, fixed income, and alternative investments, providing a comprehensive overview of our recommendations for more long-term (three-to-five-year) investment strategies.

Equities

The LPL Research SAA advises paring back its overweight exposure to equities to reflect richer valuations relative to fixed income. Given that these equities valuations relative to fixed income create a more challenging risk-reward trade-off over a 3-to-5-year time horizon, we’ve implemented a neutral equity positioning relative to benchmark levels. This adjustment reflects a slightly more cautious approach given the risk-reward scenario in today’s market environment. The SAA also suggests a reduction in the underweight to large-cap equities (mostly funded by reducing mid-caps) and a smaller allocation to international equities, from previous overweight levels, emphasizing the importance of balancing risk and reward in the current market environment.

Fixed Income

In response to increasingly competitive yields relative to recent history, the LPL Research SAA recommends increasing core fixed income holdings. Core fixed income is an attractive asset class offering diversification, liquidity, and income in multi-asset portfolios. The SAA doesn’t recommend any non-core bond allocations, and removes a previous allocation to high yield bonds, as they have become less attractive, with credit spreads (that is, the yield premium relative to U.S. Treasury bonds) remaining tight relative to history. If spreads widen, amid possible deteriorating economic conditions, the value of those bonds will be negatively impacted. The interest rate sensitivity of the core bond allocations remains around neutral relative to the benchmark. Overall, with expectations of a slow growth, low-inflation macroeconomic environment, we do believe that core bonds, especially given their diversifying attributes, can play a crucial role in optimizing risk-adjusted returns within investment objectives.

Alternative Investments

The SAA includes an allocation to alternative investments, partially funded by an underweight to cash, as these lower-correlation assets may offer a valuable opportunity to navigate uncertainty and enhance portfolio resilience amidst a lower return environment. Within alternative investments, we advise a rotation towards less market-sensitive managed futures and global macro strategies. The potential for heightened volatility and cross-asset dispersion in the market underscores the importance of diversifying strategies to hedge against economic surprises and benefit from divergent trends.

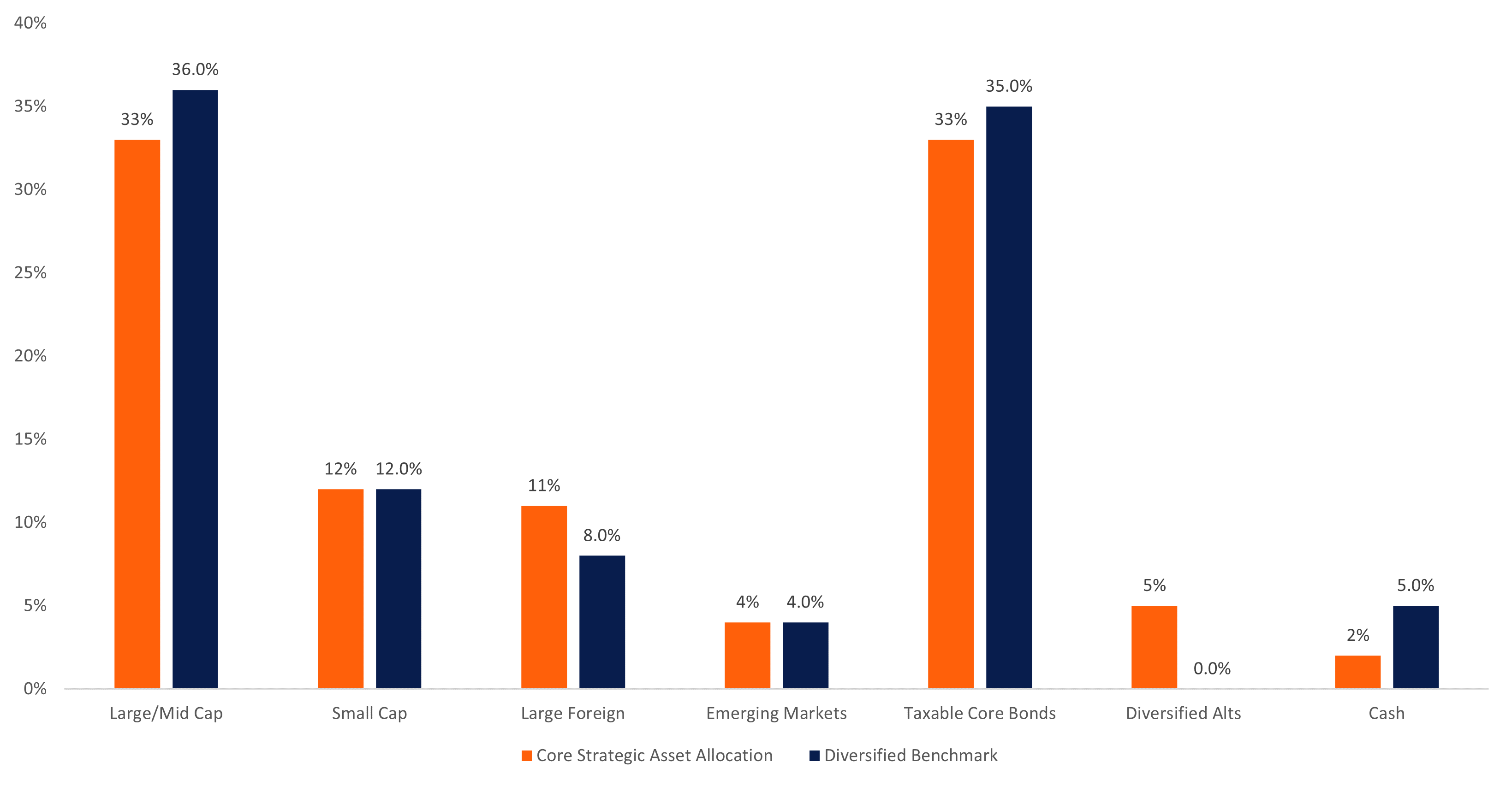

The LPL Research Growth with Income (GWI) investment objective (60 stocks /40 bonds and cash) chart reflects the strategic asset allocation compared with GWI benchmark weights.

LPL Research Growth with Income (60/40) Strategic Asset Allocation

Source: LPL Research 01/19/24

Summary

LPL Research’s 2024 Strategic Asset Allocation (SAA) update focuses on reducing risk in portfolios within long-term horizons by trimming exposure to equities and increasing exposure to fixed income and alternative investments. The STAAC outlook anticipates below-average economic growth as inflation falls back to around the Federal Reserve’s inflation objective. By emphasizing core fixed income, and incorporating alternative strategies, investors can align their portfolios with LPL’s strategic market views.

How to Implement in Model Portfolios

The LPL Research model portfolio that captures our SAA most closely is the Model Wealth Portfolios (MWP) Strategic Exchange Traded Product (ETP) model. This model has over $12 billion in assets as of February 29, with over $5 billion in the Growth with Income (60/40) investment objective. It has a 12+ year track record, following its inception in December 2011. The model leverages the SAA’s three-to-five-year strategic investment guidance provided by the STAAC, using mostly passive, cost-efficient ETPs to implement those views. The model is governed by LPL Research’s Investment Process which covers STAAC Strategic views, Investment Manager Research ETP implementation selections, Model Portfolio Committee (MPC) supervision, and Risk Management Committee oversight. For more information on this model please consult your LPL Advisor.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk.

Indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

This material was prepared by LPL Financial, LLC. All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

Unless otherwise stated LPL Financial and the third party persons and firms mentioned are not affiliates of each other and make no representation with respect to each other. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

Asset Class Disclosures –

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

Bonds are subject to market and interest rate risk if sold prior to maturity.

Municipal bonds are subject and market and interest rate risk and potentially capital gains tax if sold prior to maturity. Interest income may be subject to the alternative minimum tax. Municipal bonds are federally tax-free but other state and local taxes may apply.

Preferred stock dividends are paid at the discretion of the issuing company. Preferred stocks are subject to interest rate and credit risk. They may be subject to a call features.

Alternative investments may not be suitable for all investors and involve special risks such as leveraging the investment, potential adverse market forces, regulatory changes and potentially illiquidity. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

Mortgage backed securities are subject to credit, default, prepayment, extension, market and interest rate risk.

High yield/junk bonds (grade BB or below) are below investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

Precious metal investing involves greater fluctuation and potential for losses.

The fast price swings of commodities will result in significant volatility in an investor’s holdings.

Securities and advisory services offered through LPL Financial, a registered investment advisor and broker-dealer. Member FINRA/SIPC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value

New Year Strategies for Managing Your Wealth

Chris McCurdy, Managing Director

You work hard for your wealth, and it’s important to make sure your wealth is also working hard for you. Aligning your wealth management partner with your financial goals is crucial to achieving the lifestyle you strive for today, and the legacy you hope to leave. As the new year begins, it is an opportune time to assess your finances and consider where you are in terms of meeting specific milestones and achieving your long-term goals.

Yearlong attention to your wealth management goals should always be a priority. But as 2024 begins, the following are key Wealth Management strategies to review.

Your Relationship with Your Wealth Management Partner

A wealth management partner should feel like an extension of your family. You trust them with the details of your family finances, grant them access to your assets, and rely on them to guide your decision-making. It is important to be sure you are partnering with someone who gives you the personal attention you deserve – whether you are their wealthiest client or at earlier stages of your wealth management journey. Wealth managers should treat millionaires like billionaires – in other words, middle market clients who have investable assets of one million dollars and more deserve the same white glove treatment as those clients who have billion-dollar assets. That means a high-touch, dedicated advisor who is consistently available to answer your call, address questions and provide guidance. It means acting swiftly when a client has a request or concern. Clients of large banking institutions need to pay particular attention to the type of service they are receiving. You may not be getting the one-on-one personal service you deserve, something Signature Chicago Wealth Management prioritizes at all times.

Think About Your Tax Strategies for the New Year

It’s the beginning of a new year, an important time to be thinking about your taxes and tax strategy for the year ahead. A key component of this area is gifting and charitable contributions. Have you planned ahead for these areas in your budget? Each year, the amount of a charitable gift you can deduct against your income tax is capped at a percentage of your adjusted gross income; that percentage is higher for gifts to public charities and donor advised funds than gifts to private foundations, and is higher for gifts of cash than gifts of non-cash assets. Talk with your accountant about how your gifting may reduce your tax bill.

In addition to reviewing your gifting and other legacy issues, work with your various family advisors to identify opportunities to utilize an efficient Tax Loss Harvesting strategy. Partnering with your tax and legal advisors, your wealth manager can assess your portfolio(s) for opportunities to implement an efficient tax loss harvesting strategy. Strategize with your wealth manager and other advisors on how this may benefit you.

Schedule a meeting with your wealth manager now and plan for the future. Regardless of where you are in your wealth management journey, it is crucial to have a partner who understands your goals and is available to work with you closely every step of the way.

**This information is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

New Year Strategies for Managing Your Wealth

Chris McCurdy, Managing Director

You work hard for your wealth, and it’s important to make sure your wealth is also working hard for you. Aligning your wealth management partner with your financial goals is crucial to achieving the lifestyle you strive for today, and the legacy you hope to leave. As the new year begins, it is an opportune time to assess your finances and consider where you are in terms of meeting specific milestones and achieving your long-term goals.

Yearlong attention to your wealth management goals should always be a priority. But as 2024 begins, the following are key Wealth Management strategies to review.

Your Relationship with Your Wealth Management Partner

A wealth management partner should feel like an extension of your family. You trust them with the details of your family finances, grant them access to your assets, and rely on them to guide your decision-making. It is important to be sure you are partnering with someone who gives you the personal attention you deserve – whether you are their wealthiest client or at earlier stages of your wealth management journey. Wealth managers should treat millionaires like billionaires – in other words, middle market clients who have investable assets of one million dollars and more deserve the same white glove treatment as those clients who have billion-dollar assets. That means a high-touch, dedicated advisor who is consistently available to answer your call, address questions and provide guidance. It means acting swiftly when a client has a request or concern. Clients of large banking institutions need to pay particular attention to the type of service they are receiving. You may not be getting the one-on-one personal service you deserve, something Signature Chicago Wealth Management prioritizes at all times.

Think About Your Tax Strategies for the New Year

It’s the beginning of a new year, an important time to be thinking about your taxes and tax strategy for the year ahead. A key component of this area is gifting and charitable contributions. Have you planned ahead for these areas in your budget? Each year, the amount of a charitable gift you can deduct against your income tax is capped at a percentage of your adjusted gross income; that percentage is higher for gifts to public charities and donor advised funds than gifts to private foundations, and is higher for gifts of cash than gifts of non-cash assets. Talk with your accountant about how your gifting may reduce your tax bill.

In addition to reviewing your gifting and other legacy issues, work with your various family advisors to identify opportunities to utilize an efficient Tax Loss Harvesting strategy. Partnering with your tax and legal advisors, your wealth manager can assess your portfolio(s) for opportunities to implement an efficient tax loss harvesting strategy. Strategize with your wealth manager and other advisors on how this may benefit you.

Schedule a meeting with your wealth manager now and plan for the future. Regardless of where you are in your wealth management journey, it is crucial to have a partner who understands your goals and is available to work with you closely every step of the way.

This information is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

New Year Strategies for Managing Your Wealth

Chris McCurdy, Managing Director

You work hard for your wealth, and it’s important to make sure your wealth is also working hard for you. Aligning your wealth management partner with your financial goals is crucial to achieving the lifestyle you strive for today, and the legacy you hope to leave. As the new year begins, it is an opportune time to assess your finances and consider where you are in terms of meeting specific milestones and achieving your long-term goals.

Yearlong attention to your wealth management goals should always be a priority. But as 2024 begins, the following are key Wealth Management strategies to review.

Your Relationship with Your Wealth Management Partner

A wealth management partner should feel like an extension of your family. You trust them with the details of your family finances, grant them access to your assets, and rely on them to guide your decision-making. It is important to be sure you are partnering with someone who gives you the personal attention you deserve – whether you are their wealthiest client or at earlier stages of your wealth management journey. Wealth managers should treat millionaires like billionaires – in other words, middle market clients who have investable assets of one million dollars and more deserve the same white glove treatment as those clients who have billion-dollar assets. That means a high-touch, dedicated advisor who is consistently available to answer your call, address questions and provide guidance. It means acting swiftly when a client has a request or concern. Clients of large banking institutions need to pay particular attention to the type of service they are receiving. You may not be getting the one-on-one personal service you deserve, something Signature Chicago Wealth Management prioritizes at all times.

Think About Your Tax Strategies for the New Year

It’s the beginning of a new year, an important time to be thinking about your taxes and tax strategy for the year ahead. A key component of this area is gifting and charitable contributions. Have you planned ahead for these areas in your budget? Each year, the amount of a charitable gift you can deduct against your income tax is capped at a percentage of your adjusted gross income; that percentage is higher for gifts to public charities and donor advised funds than gifts to private foundations, and is higher for gifts of cash than gifts of non-cash assets. Talk with your accountant about how your gifting may reduce your tax bill.

In addition to reviewing your gifting and other legacy issues, work with your various family advisors to identify opportunities to utilize an efficient Tax Loss Harvesting strategy. Partnering with your tax and legal advisors, your wealth manager can assess your portfolio(s) for opportunities to implement an efficient tax loss harvesting strategy. Strategize with your wealth manager and other advisors on how this may benefit you.

Schedule a meeting with your wealth manager now and plan for the future. Regardless of where you are in your wealth management journey, it is crucial to have a partner who understands your goals and is available to work with you closely every step of the way.

This information is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

New Year Strategies for Managing Your Wealth

Chris McCurdy, Managing Director

You work hard for your wealth, and it’s important to make sure your wealth is also working hard for you. Aligning your wealth management partner with your financial goals is crucial to achieving the lifestyle you strive for today, and the legacy you hope to leave. As the new year begins, it is an opportune time to assess your finances and consider where you are in terms of meeting specific milestones and achieving your long-term goals.

Yearlong attention to your wealth management goals should always be a priority. But as 2024 begins, the following are key Wealth Management strategies to review.

Your Relationship with Your Wealth Management Partner

A wealth management partner should feel like an extension of your family. You trust them with the details of your family finances, grant them access to your assets, and rely on them to guide your decision-making. It is important to be sure you are partnering with someone who gives you the personal attention you deserve – whether you are their wealthiest client or at earlier stages of your wealth management journey. Wealth managers should treat millionaires like billionaires – in other words, middle market clients who have investable assets of one million dollars and more deserve the same white glove treatment as those clients who have billion-dollar assets. That means a high-touch, dedicated advisor who is consistently available to answer your call, address questions and provide guidance. It means acting swiftly when a client has a request or concern. Clients of large banking institutions need to pay particular attention to the type of service they are receiving. You may not be getting the one-on-one personal service you deserve, something Signature Chicago Wealth Management prioritizes at all times.

Think About Your Tax Strategies for the New Year

It’s the beginning of a new year, an important time to be thinking about your taxes and tax strategy for the year ahead. A key component of this area is gifting and charitable contributions. Have you planned ahead for these areas in your budget? Each year, the amount of a charitable gift you can deduct against your income tax is capped at a percentage of your adjusted gross income; that percentage is higher for gifts to public charities and donor advised funds than gifts to private foundations, and is higher for gifts of cash than gifts of non-cash assets. Talk with your accountant about how your gifting may reduce your tax bill.

In addition to reviewing your gifting and other legacy issues, work with your various family advisors to identify opportunities to utilize an efficient Tax Loss Harvesting strategy. Partnering with your tax and legal advisors, your wealth manager can assess your portfolio(s) for opportunities to implement an efficient tax loss harvesting strategy. Strategize with your wealth manager and other advisors on how this may benefit you.

Schedule a meeting with your wealth manager now and plan for the future. Regardless of where you are in your wealth management journey, it is crucial to have a partner who understands your goals and is available to work with you closely every step of the way.

New Year Strategies for Managing Your Wealth

Chris McCurdy, Managing Director

You work hard for your wealth, and it’s important to make sure your wealth is also working hard for you. Aligning your wealth management partner with your financial goals is crucial to achieving the lifestyle you strive for today, and the legacy you hope to leave. As the new year begins, it is an opportune time to assess your finances and consider where you are in terms of meeting specific milestones and achieving your long-term goals.

Yearlong attention to your wealth management goals should always be a priority. But as 2024 begins, the following are key Wealth Management strategies to review.

Your Relationship with Your Wealth Management Partner

A wealth management partner should feel like an extension of your family. You trust them with the details of your family finances, grant them access to your assets, and rely on them to guide your decision-making. It is important to be sure you are partnering with someone who gives you the personal attention you deserve – whether you are their wealthiest client or at earlier stages of your wealth management journey. Wealth managers should treat millionaires like billionaires – in other words, middle market clients who have investable assets of one million dollars and more deserve the same white glove treatment as those clients who have billion-dollar assets. That means a high-touch, dedicated advisor who is consistently available to answer your call, address questions and provide guidance. It means acting swiftly when a client has a request or concern. Clients of large banking institutions need to pay particular attention to the type of service they are receiving. You may not be getting the one-on-one personal service you deserve, something Signature Chicago Wealth Management prioritizes at all times.

Think About Your Tax Strategies for the New Year

It’s the beginning of a new year, an important time to be thinking about your taxes and tax strategy for the year ahead. A key component of this area is gifting and charitable contributions. Have you planned ahead for these areas in your budget? Each year, the amount of a charitable gift you can deduct against your income tax is capped at a percentage of your adjusted gross income; that percentage is higher for gifts to public charities and donor advised funds than gifts to private foundations, and is higher for gifts of cash than gifts of non-cash assets. Talk with your accountant about how your gifting may reduce your tax bill.

In addition to reviewing your gifting and other legacy issues, work with your various family advisors to identify opportunities to utilize an efficient Tax Loss Harvesting strategy. Partnering with your tax and legal advisors, your wealth manager can assess your portfolio(s) for opportunities to implement an efficient tax loss harvesting strategy. Strategize with your wealth manager and other advisors on how this may benefit you.

Schedule a meeting with your wealth manager now and plan for the future. Regardless of where you are in your wealth management journey, it is crucial to have a partner who understands your goals and is available to work with you closely every step of the way.

How Could the Markets Surprise Us in 2024?

Kristian Kerr | Head of Macro Strategy

Byron Wien recently passed away. He was a true Wall Street icon. I had the good fortune of meeting Mr. Wien once when I was seated behind him at an investment conference during the depths of the Great Financial Crisis (GFC). Mr. Wien was probably best known for his annual top ten list of surprises for the year ahead. He defined a surprise on his list as something that the average investor would only assign about a one-in-three chance of occurring, but that he thought was closer to 50/50. I always thought this was a useful exercise. Markets have a way of habitually surprising us and proving the conventional thinking wrong, so having an idea of where the potential forks in the road may come just makes us better prepared and informed as investors.

Below is my compilation of five potential surprises for markets in 2024. Mr. Wien would do 10, but I reduced it to five for the sake of brevity. Please remember these are not all meant to be seen as forecasts or base-case views, but rather a thought exercise around potential risks and opportunities that the markets might be overly discounting in 2024.

Five Surprises for 2024 (in no particular order)

- Inflation doesn’t ride off into the sunset. Perhaps the most consensus opinion out there at the moment is that inflation has been defeated. Lingering butterfly effects from the COVID-19 years, severe neglect in commodities-related capital expenditures, significant fiscal stimulus still percolating through the system, and an escalating geopolitical situation warn inflation might not be so easily tamed. Inflation historically happens in waves, so another impulse would not be out of character with the historical precedence.

- AI optimism takes a breather. The move in Artificial Intelligence (AI) stocks has been relentless and has drawn many comparisons with the dot.com boom. It is almost impossible to handicap the proliferation of a new technology, but assuming AI is the real deal and using the 1990s and other historical examples as a guide, then the likely path is to get an initial boom followed by a material correction of some sort. The next advance that then follows is where the real winners of the new technology are determined. The current first wave in AI is arguably long in the tooth, but admittedly these things can last longer than anyone thinks possible, so maybe it is more of a 2025 story, but there are certainly some risks that the first wave finishes this year, and the AI theme enters a winter period.

- Chinese equities surprise to the upside. The economic situation in China is clearly not good, but everyone knows that, and a lot of the negatives have already been priced in. Chinese policymakers are not at all incentivized to pursue a laissez-faire approach here. As the old trading floor saying goes, “markets stop panicking when policy makers start to panic.” That moment probably happens sooner than later, and Chinese equities could get a decent tailwind.

- U.S. longer-term bond yields bottom quicker than most would expect. The secular bear market in bond yields looks to have ended in 2022. As a result, yields shouldn’t be as predisposed as they once were to head for levels much lower than 3% in the 10-year, even in the event of recession. If a multi-year trend higher is emerging as the charts suggest, then the risk is that longer-term Treasury yields find a floor sooner than later (months instead of years) and fiscal/supply concerns come back into focus as soon as the second half of this year.

- The U.S. dollar continues to confound. On paper, the dollar should be lower. Historically, rich valuations, shrinking interest rate differentials, internal U.S. political strife, and growing fiscal concerns are just a few of the reasons people give for why the dollar should be weaker. However, what makes currencies different is they are priced relative to each other, and in many ways the dollar is still the “least dirty shirt in the laundry basket” when viewed from this perspective. Being the world’s reserve currency comes with many privileges, not least of which is the favored destination of global capital during times of geopolitical and global economic uncertainty.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk.

Indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

This material was prepared by LPL Financial, LLC. All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

Unless otherwise stated LPL Financial and the third party persons and firms mentioned are not affiliates of each other and make no representation with respect to each other. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

Asset Class Disclosures –

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

Bonds are subject to market and interest rate risk if sold prior to maturity.

Municipal bonds are subject and market and interest rate risk and potentially capital gains tax if sold prior to maturity. Interest income may be subject to the alternative minimum tax. Municipal bonds are federally tax-free but other state and local taxes may apply.

Preferred stock dividends are paid at the discretion of the issuing company. Preferred stocks are subject to interest rate and credit risk. They may be subject to a call features.

Alternative investments may not be suitable for all investors and involve special risks such as leveraging the investment, potential adverse market forces, regulatory changes and potentially illiquidity. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

Mortgage backed securities are subject to credit, default, prepayment, extension, market and interest rate risk.

High yield/junk bonds (grade BB or below) are below investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

Precious metal investing involves greater fluctuation and potential for losses.

The fast price swings of commodities will result in significant volatility in an investor’s holdings.

Securities and advisory services offered through LPL Financial, a registered investment advisor and broker-dealer. Member FINRA/SIPC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value