As you are aware, the FDIC recently enforced two bank closures. To strengthen public confidence in the U.S. banking system, the FDIC took the additional step of covering all of the uninsured depositors at those banks. One of those closures occurred yesterday with a bank that has a name similar to ours – Signature Bank New York. We want to assure our clients, prospects, and partners that Signature Bank Chicago is not affiliated with this bank in any way and that Signature Bank Chicago is well capitalized and positioned for success, coming off of a record year in 2022.

Wealth Management

Signature Bank Implements New Consumer and Business Programs for Veterans

Savings and business products offered to support veterans and win their business

Signature Bank Exceeds $100 Million In Assets

Chicago De Novo Bank Succeeds In Beating Benchmark And Continues Momentum With Additional Hiring

Signature Bank Celebrates Anniversary by Achieving Profitability and Preparing for Expansion

Chicago De Novo Bank Set to Open Second Branch on News of Third Quarter Profitability

Signature Bank Expands With Downtown Chicago Branch

Chicago De Novo Bank Opens Second Branch in Chicago Loop

Signature Bank Celebrates Grand Opening of Chicago Headquarters Branch with Open House

New Chicago Bank Officially Opens Doors to the Public with Special Offers and Festival Activities for Community on Saturday, October 21, 2006

Strategic Asset Allocation: A 3-to-5-Year Perspective of Markets

George Smith | Portfolio Strategist

Additional content provided by John Lohse, Sr. Analyst, Research.

This year, investors encounter a unique array of challenges and opportunities within the financial markets. LPL Research’s recently updated Strategic Asset Allocation (SAA) and Capital Market Assumptions (CMA) offer valuable insights for navigating this environment. The SAA was developed through an analytical combination of mind and machine that incorporates quantitative modeling with team-based input and overlay from LPL’s Strategic and Tactical Asset Allocation Committee (STAAC). We explore LPL’s strategic views on equities, fixed income, and alternative investments, providing a comprehensive overview of our recommendations for more long-term (three-to-five-year) investment strategies.

Equities

The LPL Research SAA advises paring back its overweight exposure to equities to reflect richer valuations relative to fixed income. Given that these equities valuations relative to fixed income create a more challenging risk-reward trade-off over a 3-to-5-year time horizon, we’ve implemented a neutral equity positioning relative to benchmark levels. This adjustment reflects a slightly more cautious approach given the risk-reward scenario in today’s market environment. The SAA also suggests a reduction in the underweight to large-cap equities (mostly funded by reducing mid-caps) and a smaller allocation to international equities, from previous overweight levels, emphasizing the importance of balancing risk and reward in the current market environment.

Fixed Income

In response to increasingly competitive yields relative to recent history, the LPL Research SAA recommends increasing core fixed income holdings. Core fixed income is an attractive asset class offering diversification, liquidity, and income in multi-asset portfolios. The SAA doesn’t recommend any non-core bond allocations, and removes a previous allocation to high yield bonds, as they have become less attractive, with credit spreads (that is, the yield premium relative to U.S. Treasury bonds) remaining tight relative to history. If spreads widen, amid possible deteriorating economic conditions, the value of those bonds will be negatively impacted. The interest rate sensitivity of the core bond allocations remains around neutral relative to the benchmark. Overall, with expectations of a slow growth, low-inflation macroeconomic environment, we do believe that core bonds, especially given their diversifying attributes, can play a crucial role in optimizing risk-adjusted returns within investment objectives.

Alternative Investments

The SAA includes an allocation to alternative investments, partially funded by an underweight to cash, as these lower-correlation assets may offer a valuable opportunity to navigate uncertainty and enhance portfolio resilience amidst a lower return environment. Within alternative investments, we advise a rotation towards less market-sensitive managed futures and global macro strategies. The potential for heightened volatility and cross-asset dispersion in the market underscores the importance of diversifying strategies to hedge against economic surprises and benefit from divergent trends.

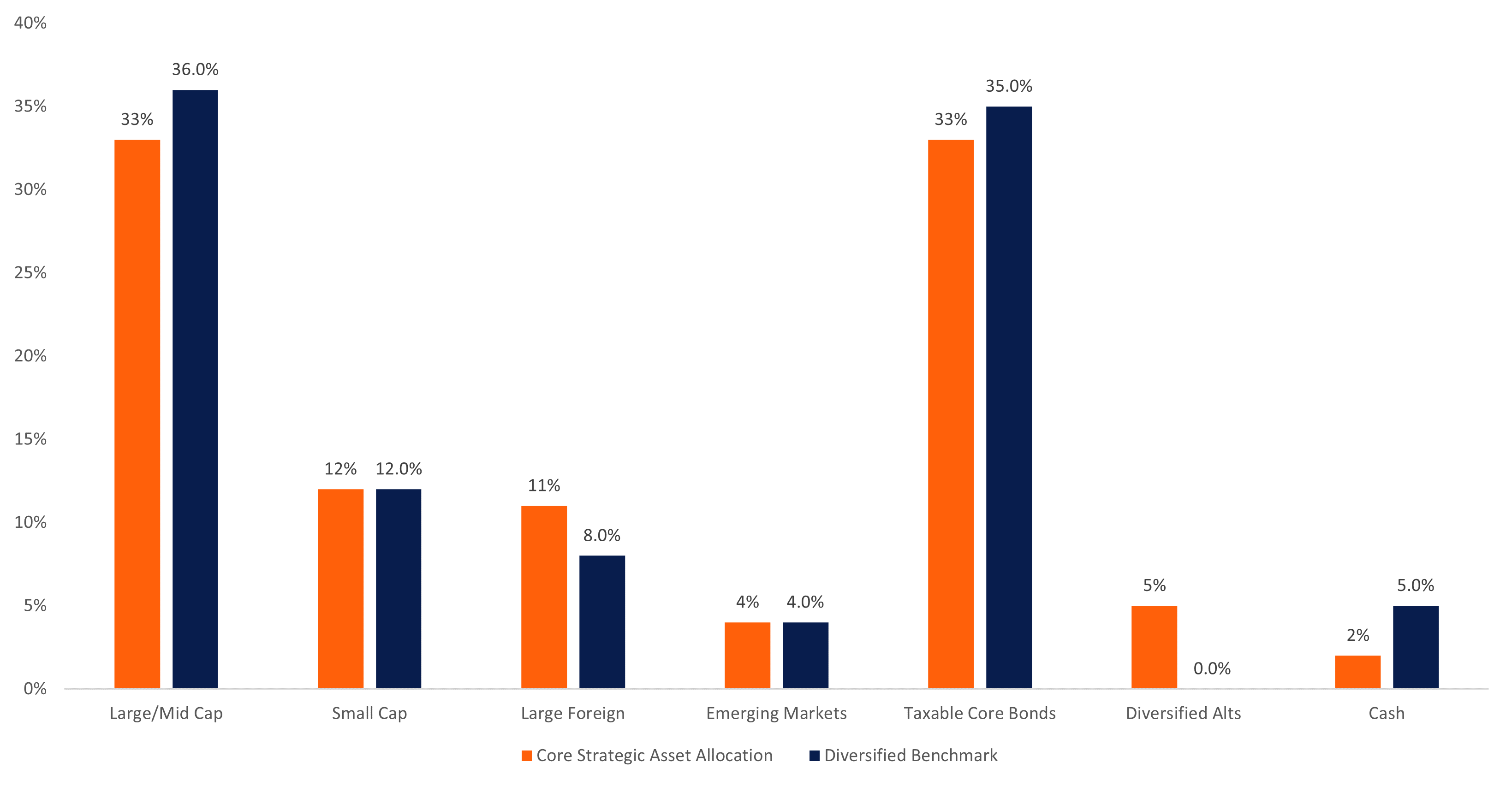

The LPL Research Growth with Income (GWI) investment objective (60 stocks /40 bonds and cash) chart reflects the strategic asset allocation compared with GWI benchmark weights.

LPL Research Growth with Income (60/40) Strategic Asset Allocation

Source: LPL Research 01/19/24

Summary

LPL Research’s 2024 Strategic Asset Allocation (SAA) update focuses on reducing risk in portfolios within long-term horizons by trimming exposure to equities and increasing exposure to fixed income and alternative investments. The STAAC outlook anticipates below-average economic growth as inflation falls back to around the Federal Reserve’s inflation objective. By emphasizing core fixed income, and incorporating alternative strategies, investors can align their portfolios with LPL’s strategic market views.

How to Implement in Model Portfolios

The LPL Research model portfolio that captures our SAA most closely is the Model Wealth Portfolios (MWP) Strategic Exchange Traded Product (ETP) model. This model has over $12 billion in assets as of February 29, with over $5 billion in the Growth with Income (60/40) investment objective. It has a 12+ year track record, following its inception in December 2011. The model leverages the SAA’s three-to-five-year strategic investment guidance provided by the STAAC, using mostly passive, cost-efficient ETPs to implement those views. The model is governed by LPL Research’s Investment Process which covers STAAC Strategic views, Investment Manager Research ETP implementation selections, Model Portfolio Committee (MPC) supervision, and Risk Management Committee oversight. For more information on this model please consult your LPL Advisor.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk.

Indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

This material was prepared by LPL Financial, LLC. All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

Unless otherwise stated LPL Financial and the third party persons and firms mentioned are not affiliates of each other and make no representation with respect to each other. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

Asset Class Disclosures –

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

Bonds are subject to market and interest rate risk if sold prior to maturity.

Municipal bonds are subject and market and interest rate risk and potentially capital gains tax if sold prior to maturity. Interest income may be subject to the alternative minimum tax. Municipal bonds are federally tax-free but other state and local taxes may apply.

Preferred stock dividends are paid at the discretion of the issuing company. Preferred stocks are subject to interest rate and credit risk. They may be subject to a call features.

Alternative investments may not be suitable for all investors and involve special risks such as leveraging the investment, potential adverse market forces, regulatory changes and potentially illiquidity. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

Mortgage backed securities are subject to credit, default, prepayment, extension, market and interest rate risk.

High yield/junk bonds (grade BB or below) are below investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

Precious metal investing involves greater fluctuation and potential for losses.

The fast price swings of commodities will result in significant volatility in an investor’s holdings.

Securities and advisory services offered through LPL Financial, a registered investment advisor and broker-dealer. Member FINRA/SIPC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value

New Year Strategies for Managing Your Wealth

Chris McCurdy, Managing Director

You work hard for your wealth, and it’s important to make sure your wealth is also working hard for you. Aligning your wealth management partner with your financial goals is crucial to achieving the lifestyle you strive for today, and the legacy you hope to leave. As the new year begins, it is an opportune time to assess your finances and consider where you are in terms of meeting specific milestones and achieving your long-term goals.

Yearlong attention to your wealth management goals should always be a priority. But as 2024 begins, the following are key Wealth Management strategies to review.

Your Relationship with Your Wealth Management Partner

A wealth management partner should feel like an extension of your family. You trust them with the details of your family finances, grant them access to your assets, and rely on them to guide your decision-making. It is important to be sure you are partnering with someone who gives you the personal attention you deserve – whether you are their wealthiest client or at earlier stages of your wealth management journey. Wealth managers should treat millionaires like billionaires – in other words, middle market clients who have investable assets of one million dollars and more deserve the same white glove treatment as those clients who have billion-dollar assets. That means a high-touch, dedicated advisor who is consistently available to answer your call, address questions and provide guidance. It means acting swiftly when a client has a request or concern. Clients of large banking institutions need to pay particular attention to the type of service they are receiving. You may not be getting the one-on-one personal service you deserve, something Signature Chicago Wealth Management prioritizes at all times.

Think About Your Tax Strategies for the New Year

It’s the beginning of a new year, an important time to be thinking about your taxes and tax strategy for the year ahead. A key component of this area is gifting and charitable contributions. Have you planned ahead for these areas in your budget? Each year, the amount of a charitable gift you can deduct against your income tax is capped at a percentage of your adjusted gross income; that percentage is higher for gifts to public charities and donor advised funds than gifts to private foundations, and is higher for gifts of cash than gifts of non-cash assets. Talk with your accountant about how your gifting may reduce your tax bill.

In addition to reviewing your gifting and other legacy issues, work with your various family advisors to identify opportunities to utilize an efficient Tax Loss Harvesting strategy. Partnering with your tax and legal advisors, your wealth manager can assess your portfolio(s) for opportunities to implement an efficient tax loss harvesting strategy. Strategize with your wealth manager and other advisors on how this may benefit you.

Schedule a meeting with your wealth manager now and plan for the future. Regardless of where you are in your wealth management journey, it is crucial to have a partner who understands your goals and is available to work with you closely every step of the way.

**This information is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

New Year Strategies for Managing Your Wealth

Chris McCurdy, Managing Director

You work hard for your wealth, and it’s important to make sure your wealth is also working hard for you. Aligning your wealth management partner with your financial goals is crucial to achieving the lifestyle you strive for today, and the legacy you hope to leave. As the new year begins, it is an opportune time to assess your finances and consider where you are in terms of meeting specific milestones and achieving your long-term goals.

Yearlong attention to your wealth management goals should always be a priority. But as 2024 begins, the following are key Wealth Management strategies to review.

Your Relationship with Your Wealth Management Partner

A wealth management partner should feel like an extension of your family. You trust them with the details of your family finances, grant them access to your assets, and rely on them to guide your decision-making. It is important to be sure you are partnering with someone who gives you the personal attention you deserve – whether you are their wealthiest client or at earlier stages of your wealth management journey. Wealth managers should treat millionaires like billionaires – in other words, middle market clients who have investable assets of one million dollars and more deserve the same white glove treatment as those clients who have billion-dollar assets. That means a high-touch, dedicated advisor who is consistently available to answer your call, address questions and provide guidance. It means acting swiftly when a client has a request or concern. Clients of large banking institutions need to pay particular attention to the type of service they are receiving. You may not be getting the one-on-one personal service you deserve, something Signature Chicago Wealth Management prioritizes at all times.

Think About Your Tax Strategies for the New Year

It’s the beginning of a new year, an important time to be thinking about your taxes and tax strategy for the year ahead. A key component of this area is gifting and charitable contributions. Have you planned ahead for these areas in your budget? Each year, the amount of a charitable gift you can deduct against your income tax is capped at a percentage of your adjusted gross income; that percentage is higher for gifts to public charities and donor advised funds than gifts to private foundations, and is higher for gifts of cash than gifts of non-cash assets. Talk with your accountant about how your gifting may reduce your tax bill.

In addition to reviewing your gifting and other legacy issues, work with your various family advisors to identify opportunities to utilize an efficient Tax Loss Harvesting strategy. Partnering with your tax and legal advisors, your wealth manager can assess your portfolio(s) for opportunities to implement an efficient tax loss harvesting strategy. Strategize with your wealth manager and other advisors on how this may benefit you.

Schedule a meeting with your wealth manager now and plan for the future. Regardless of where you are in your wealth management journey, it is crucial to have a partner who understands your goals and is available to work with you closely every step of the way.

This information is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

New Year Strategies for Managing Your Wealth

Chris McCurdy, Managing Director

You work hard for your wealth, and it’s important to make sure your wealth is also working hard for you. Aligning your wealth management partner with your financial goals is crucial to achieving the lifestyle you strive for today, and the legacy you hope to leave. As the new year begins, it is an opportune time to assess your finances and consider where you are in terms of meeting specific milestones and achieving your long-term goals.

Yearlong attention to your wealth management goals should always be a priority. But as 2024 begins, the following are key Wealth Management strategies to review.

Your Relationship with Your Wealth Management Partner

A wealth management partner should feel like an extension of your family. You trust them with the details of your family finances, grant them access to your assets, and rely on them to guide your decision-making. It is important to be sure you are partnering with someone who gives you the personal attention you deserve – whether you are their wealthiest client or at earlier stages of your wealth management journey. Wealth managers should treat millionaires like billionaires – in other words, middle market clients who have investable assets of one million dollars and more deserve the same white glove treatment as those clients who have billion-dollar assets. That means a high-touch, dedicated advisor who is consistently available to answer your call, address questions and provide guidance. It means acting swiftly when a client has a request or concern. Clients of large banking institutions need to pay particular attention to the type of service they are receiving. You may not be getting the one-on-one personal service you deserve, something Signature Chicago Wealth Management prioritizes at all times.

Think About Your Tax Strategies for the New Year

It’s the beginning of a new year, an important time to be thinking about your taxes and tax strategy for the year ahead. A key component of this area is gifting and charitable contributions. Have you planned ahead for these areas in your budget? Each year, the amount of a charitable gift you can deduct against your income tax is capped at a percentage of your adjusted gross income; that percentage is higher for gifts to public charities and donor advised funds than gifts to private foundations, and is higher for gifts of cash than gifts of non-cash assets. Talk with your accountant about how your gifting may reduce your tax bill.

In addition to reviewing your gifting and other legacy issues, work with your various family advisors to identify opportunities to utilize an efficient Tax Loss Harvesting strategy. Partnering with your tax and legal advisors, your wealth manager can assess your portfolio(s) for opportunities to implement an efficient tax loss harvesting strategy. Strategize with your wealth manager and other advisors on how this may benefit you.

Schedule a meeting with your wealth manager now and plan for the future. Regardless of where you are in your wealth management journey, it is crucial to have a partner who understands your goals and is available to work with you closely every step of the way.

This information is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.