Wealth Management

The Laggards of 2022 Became Leaders in 2023

LPL Research explores the best and worst-performing S&P 500 sectors of 2023 and the likelihood for a convergence in performance this year.

Weekly Market Performance — January 5, 2024

LPL’s Weekly Market Performance for the week of January 1, 2024, highlights the end of the market’s nine-week winning streak, the FOMC minutes, and ISM data.

The Santa Claus Rally Ends on the Naughty List

Adam Turnquist | Chief Technical Strategist

Additional content provided by Colby Hesson, Analyst.

Yesterday marked the end of the historically strong seasonal period called the Santa Claus Rally, technically classified as the last five trading days of the year plus the first two trading days of the new year. Since 1950, the S&P 500 has generated an above-average 1.3% return during this short seven-day window, but this time the S&P 500 fell -1.1%. This is the 16th time since 1950 that the S&P 500 closed lower during this period, snapping a seven-year streak of positive returns during the Santa Claus Rally. Now that the streak is over, the market is on the naughty list, with the S&P 500 historically generating an average annual return of only 4.1% when Santa doesn’t show up.

Returns during the Santa Claus Rally period have historically correlated well with January and subsequent year returns, which may not bode well for investors this year. According to the data below, when Santa is a no show, the S&P 500 slightly underperforms in January, on average, and ends the month in the red 60% of the time. Furthermore, full-year returns have been underwhelming when considering the S&P 500’s average annual return since 1950 is 9.3%.

Santa No Shows

| Average | Median | % Positive | |

| January Return | -0.3% | -1.8% | 40.0% |

| Next Year Return | 4.1% | 3.0% | 66.7% |

Source: LPL Research, Bloomberg 01/03/24

Disclosures: Past performance is no guarantee of future results. All indexes are unmanaged and can’t be invested in directly.

The modern design of the S&P 500 stock index was first launched in 1957. Performance back to 1950 incorporates the performance of the predecessor index, the S&P 90.

Santa does make mistakes from time to time, and the market can still wind up with an attractive return over the following year. For example, 20% of the positive returns in January following a negative Santa Claus Rally were greater than 5%, while 20% of the positive returns by year end were also greater than 20%. While we may not be in for another 20% plus year like 2023, momentum into the new year does suggest we could experience another solid year. Historically, when the S&P 500 returns 20% or more during a calendar year, the index gains an average of 9.6% the following year. There is still a long 12 months ahead for the equity market to go in either direction.

Conclusion

While negative Santa Claus rally periods have traditionally signaled poor market performance the following year, LPL Research believes there are plenty of catalysts for the market to offset potentially weak seasonality. In 2024, equities should benefit from falling inflation and interest rates, the conclusion of the Federal Reserve’s rate-hiking campaign and improved corporate profitability. We remain neutral on equities, sourcing the slight fixed income overweight from cash relative to appropriate benchmarks.

Finally, the Santa Claus Rally period is only one piece of the seasonality puzzle, so watch for additional updates from LPL Research on the first five days of January indicator and the January Barometer as we progress through the month.

For more details on LPL Research’s outlook for the markets and economy in 2024, please refer to Outlook 2024: A Turning Point.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk.

Indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

This material was prepared by LPL Financial, LLC. All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

Unless otherwise stated LPL Financial and the third party persons and firms mentioned are not affiliates of each other and make no representation with respect to each other. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

Asset Class Disclosures –

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

Bonds are subject to market and interest rate risk if sold prior to maturity.

Municipal bonds are subject and market and interest rate risk and potentially capital gains tax if sold prior to maturity. Interest income may be subject to the alternative minimum tax. Municipal bonds are federally tax-free but other state and local taxes may apply.

Preferred stock dividends are paid at the discretion of the issuing company. Preferred stocks are subject to interest rate and credit risk. They may be subject to a call features.

Alternative investments may not be suitable for all investors and involve special risks such as leveraging the investment, potential adverse market forces, regulatory changes and potentially illiquidity. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

Mortgage backed securities are subject to credit, default, prepayment, extension, market and interest rate risk.

High yield/junk bonds (grade BB or below) are below investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

Precious metal investing involves greater fluctuation and potential for losses.

The fast price swings of commodities will result in significant volatility in an investor’s holdings.

Securities and advisory services offered through LPL Financial, a registered investment advisor and broker-dealer. Member FINRA/SIPC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value

What Will Stocks Do for an Encore in 2024?

LPL Research explores how the market has historically performed following outsized annual gains.

Weekly Market Performance — December 29, 2023

LPL’s Weekly Market Performance for the week of Dec. 25, 2023, recaps a higher week for markets, a decline in natural gas prices, and a jump in home prices.

January Seasonality: Have Returns Been Pulled Forward?

LPL Research assesses stock market seasonals and what they could infer for stock market returns going forward.

Top-Heavy Doesn’t Mean Market Top

Adam Turnquist | Chief Technical Strategist

Key Takeaways:

- This year will likely be remembered as the year of the Magnificent Seven. While these stocks have done most of the heavy lifting for the S&P 500, it has not been a zero-sum game, as several offensive-tilted sector stocks are also beating the market this year.

- While periods of narrow leadership present concentration risk and a lack of participation from other important sectors, they have historically not been a precursor to a market top. For example, S&P 500 annual returns following its 10 most top-heavy years averaged 14.1%, with 80% of occurrences finishing in positive territory.

- Following year index returns after the 10 most top-heavy S&P 500 years have averaged 14.1%, with 80% of occurrences finishing in positive territory.

- LPL Research believes the large cap growth narrative will remain intact in 2024 and expects a continuation of offensive sector leadership.

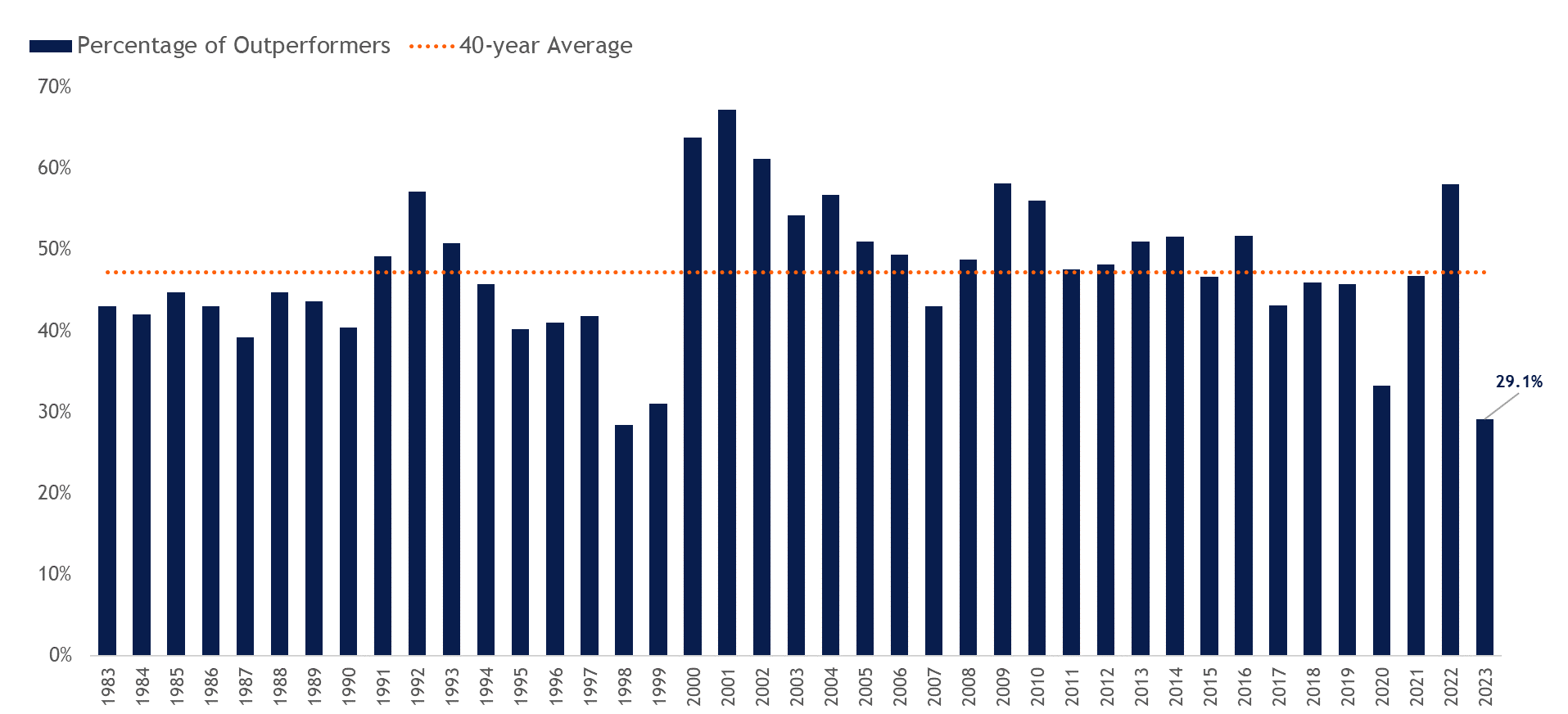

Narrow leadership has been one of the major themes throughout 2023. The so-called Magnificent Seven mega-caps — Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla — have contributed to 60% of the S&P 500’s 26.5% total year-to-date return (as of December 27). Given this top-heavy concentration and a lack of participation from the financial sector for most of the year (the sector with the second-highest number of S&P 500 stocks), only around 29% of S&P 500 constituents are beating the index on a total return basis this year. The chart below highlights that 2023 will likely have one of the lowest percentages of stocks outperforming the market over the last 40 years.

One of the Narrowest Leadership Years in 40 Years

Percentage of S&P 500 Outperformers by Year

Source: LPL Research, Bloomberg 12/27/23

Disclosures: Past performance is no guarantee of future results.

All indexes are unmanaged and can’t be invested in directly.

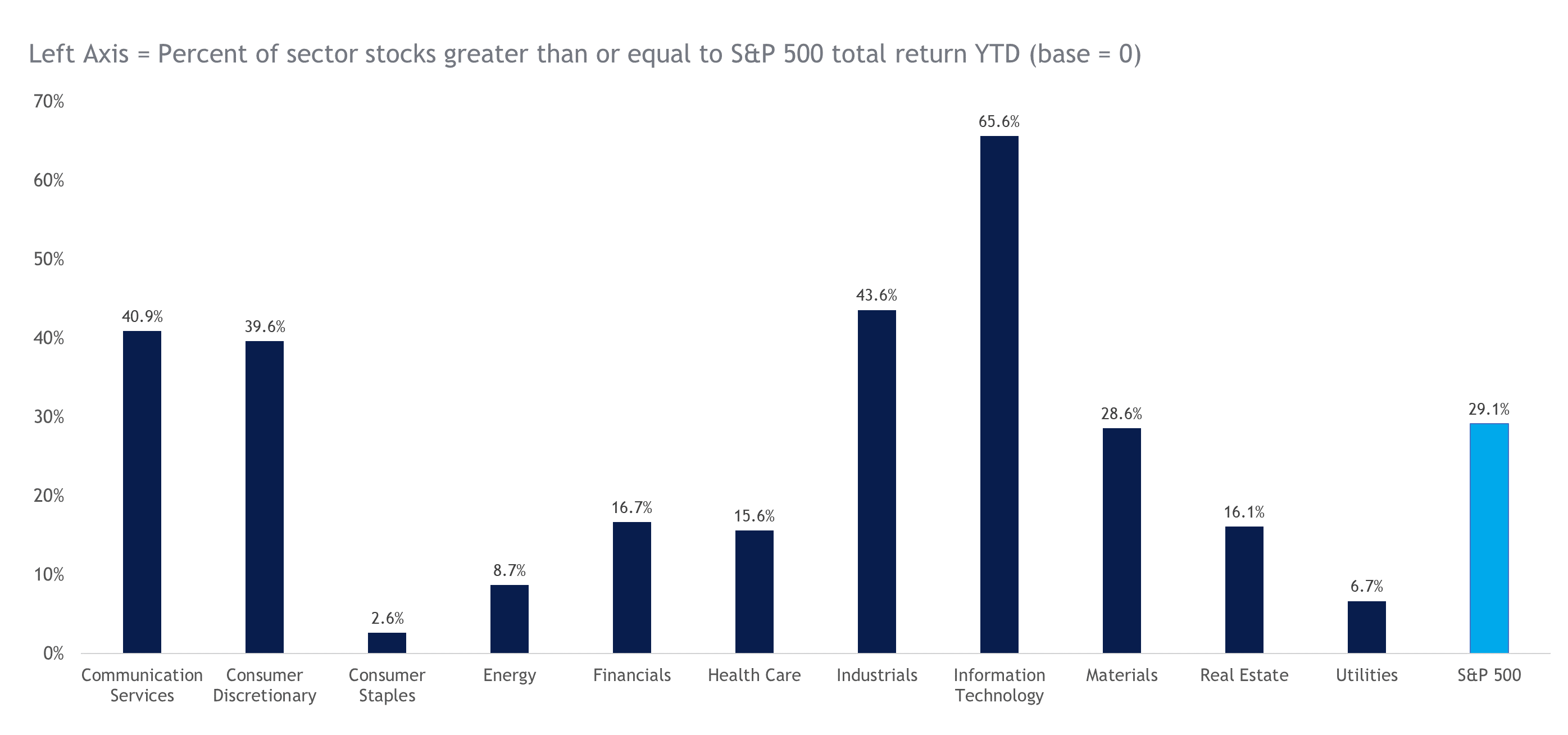

Not a Zero-Sum Game

This year’s outsized gains and contributions from the Magnificent Seven have largely overshadowed pockets of relative strength across several S&P 500 sectors. As illustrated in the table below, it is not a zero-sum game as roughly two-thirds of technology sector stocks are beating the tape this year, while around 40% of communication services, consumer discretionary, and industrial stocks are also outperforming. Collectively, these three sectors and technology represent around a 57% weighting within the S&P 500.

Percentage of Sector Stocks Outperforming This Year

Source: LPL Research, Bloomberg 12/27/23

Disclosures: Past performance is no guarantee of future results.

All indexes are unmanaged and can’t be invested in directly.

While 2023 will likely have one of the lowest percentages of stocks beating the market in 40 years, history suggests top-heavy years don’t translate into market tops over the following year. As illustrated in the table below, S&P 500 annual returns following its 10 most top-heavy years averaged 14.1%, with 80% of occurrences finishing in positive territory. For those expecting a small cap catch-up rally next year, we also included the following year’s returns for the small cap Russell 2000 Index. While small caps outperformed the S&P 500 60% of the time over the next year, both the average and median Russell 2000 returns were underwhelming relative to the S&P 500.

Top-Heavy Doesn’t Mean Market Top

Ten Most Top-Heavy S&P 500 Years

| Year | Percentage of S&P 500 Outperformers | S&P 500 Annual Return | Next Year S&P 500 Return | Next Year Russell 2000 Return | Next Year S&P 500 vs. Russell 2000 |

| 1998 | 28.4% | 26.7% | 19.5% | 19.6% | -0.1% |

| 2023 | 29.1% | – | – | – | – |

| 1999 | 31.0% | 19.5% | -10.1% | -4.3% | -5.8% |

| 2020 | 33.3% | 16.3% | 26.9% | 13.7% | 13.2% |

| 1987 | 39.2% | 2.0% | 12.4% | 22.4% | -10.0% |

| 1995 | 40.2% | 34.1% | 20.3% | 14.8% | 5.5% |

| 1990 | 40.4% | -6.6% | 26.3% | 43.4% | -17.0% |

| 1996 | 41.0% | 20.3% | 31.0% | 20.7% | 10.3% |

| 1997 | 41.8% | 31.0% | 26.7% | -3.8% | 30.5% |

| 1984 | 42.0% | 1.4% | 26.3% | 28.0% | -1.6% |

| 2007 | 43.0% | 3.5% | -38.5% | -34.8% | -3.7% |

| Average | 14.8% | 14.1% | 12.0% | 2.1% | |

| Median | 17.9% | 23.3% | 17.2% | -0.8% | |

| Percent Positive | 90.0% | 80.0% | 70.0% | 40.0% |

Source: LPL Research, Bloomberg 12/27/23

Disclosures: Past performance is no guarantee of future results.

All indexes are unmanaged and can’t be invested in directly.

Summary

The narrow leadership theme of 2023 has gained a lot of attention due to the historically outsized contributions from the Magnificent Seven stocks. While periods of narrow leadership present concentration risk and a lack of participation from other important sectors, they have not historically been a precursor to a market top. In addition, there is still a sizable percentage of offensive sector stocks beating the market this year, a largely overlooked storyline. Looking ahead to 2024, LPL Research’s Strategic and Tactical Asset Allocation Committee (STAAC) believes the large cap growth narrative will remain intact and is tactically overweight growth-style equities relative to value. The STAAC also expects a continuation of offensive sector leadership, including overlooked sectors like financials, as they finally start to participate in this bull market.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk.

Indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

This material was prepared by LPL Financial, LLC. All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

Unless otherwise stated LPL Financial and the third party persons and firms mentioned are not affiliates of each other and make no representation with respect to each other. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

Asset Class Disclosures –

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

Bonds are subject to market and interest rate risk if sold prior to maturity.

Municipal bonds are subject and market and interest rate risk and potentially capital gains tax if sold prior to maturity. Interest income may be subject to the alternative minimum tax. Municipal bonds are federally tax-free but other state and local taxes may apply.

Preferred stock dividends are paid at the discretion of the issuing company. Preferred stocks are subject to interest rate and credit risk. They may be subject to a call features.

Alternative investments may not be suitable for all investors and involve special risks such as leveraging the investment, potential adverse market forces, regulatory changes and potentially illiquidity. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

Mortgage backed securities are subject to credit, default, prepayment, extension, market and interest rate risk.

High yield/junk bonds (grade BB or below) are below investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

Precious metal investing involves greater fluctuation and potential for losses.

The fast price swings of commodities will result in significant volatility in an investor’s holdings.

Securities and advisory services offered through LPL Financial, a registered investment advisor and broker-dealer. Member FINRA/SIPC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value

Investors Approaching Extreme Bullishness

George Smith | Portfolio Strategist

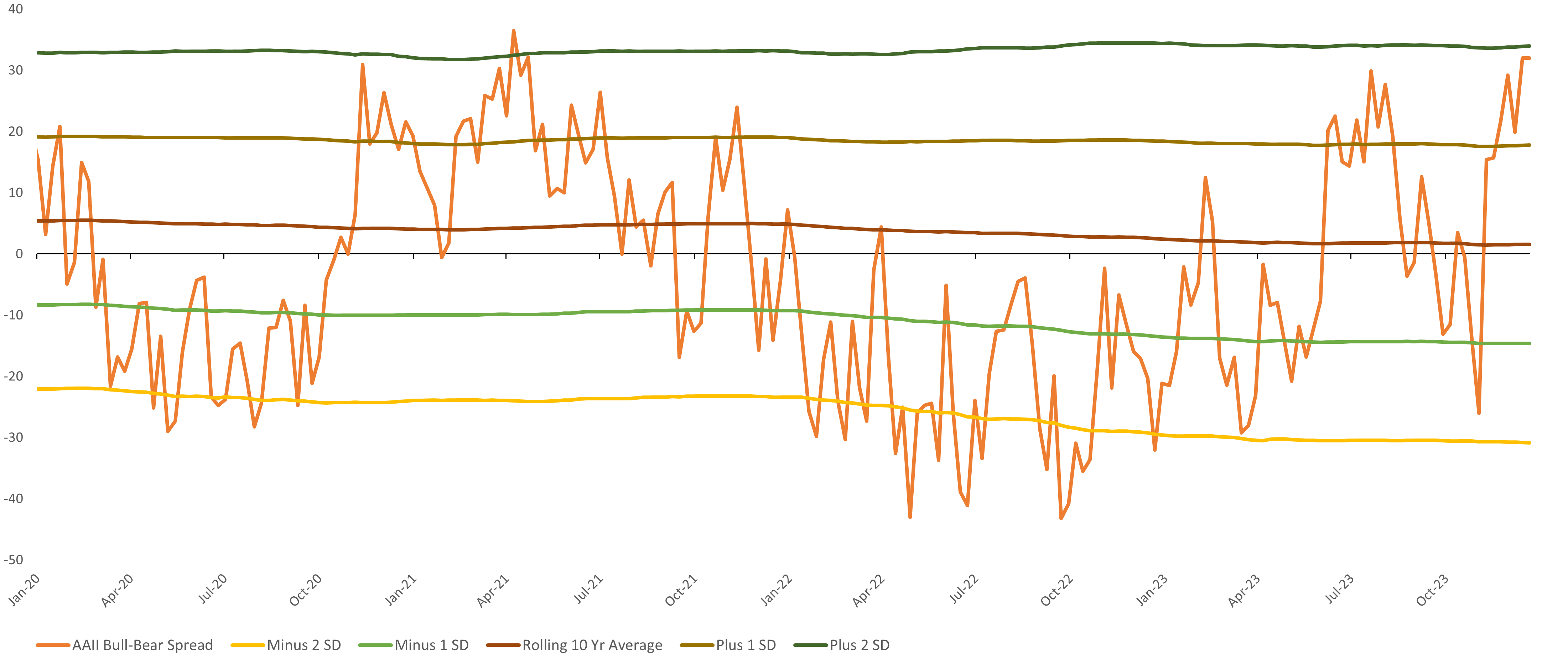

Last week, the American Association of Individual Investors (AAII) released their weekly sentiment survey data, which showed that individual investors have experienced a large amount of holiday cheer due to the stock market rally in December. The percentage of individual investors who are bullish about short-term market expectations rose to around 53%, while the percentage of investors who are bearish is 21%. This puts the spread between the bulls and the bears at 32% versus a long-term average of around 2%.

Investors have become their most bullish since April 2021, according to the AAII survey. The weekly reading is the seventh highest in the past 10 years, largely due to the recent stock market rally, expectations of interest rate stability, and lower inflation data.

The bull-bear spread at 32%, is the 11th highest weekly reading in the last 10 years and has jumped 58% from minus 26% only six weeks ago. This increase is extreme at almost +3 standard deviations above the average six-week move, and it is the seventh-highest six-week jump since the survey started in 1988. While the bull-bear spread itself is high compared to recent history, it is not extreme — yet.

As illustrated in the chart below, investor sentiment, as measured by the spread between bulls and bears in the AAII survey data, is approaching, but not yet at, extreme bullishness, as defined by being more than two standard deviations above the long-term average. The last time this statistic reached the extreme bullishness threshold was in April 2021.

Individual Investors Approaching Extreme Bullishness

Bull-Bear Spread Has Jumped 58 Points in Six Weeks

Source: LPL Research, AAII, Bloomberg, 12/22/23

Disclosures: All indexes are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results.

We generally consider investor sentiment from a contrarian perspective, so the fact that this indicator is near bullish extremes has tended to be a detractor for stock price returns. Historically, when the bull-bear spread has been at comparable levels (between one and two standard deviations above average), S&P 500 returns have been slightly below average (but still positive). Where the data gets more concerning for stock market investors is when sentiment gets to extreme bullishness, above two standard deviations from the mean, as this has historically led to negative returns both six months and a year out.

Bullish Investor Sentiment Tends to Precede Slightly Below-Average (but Positive) Returns

Average S&P 500 Returns

| AAII Bull-Bear Spread | Percent of the Time | 3 Month Average Returns | 6 Month Average Returns | 1 Year Average Return |

| Very Bearish: Below 2 std. dev (Below -31) | 4.2% | 2.6% | 5.5% | 10.5% |

| Bearish: -1 to -2 std. dev (-31 to -14) | 15.4% | 3.0% | 5.4% | 10.2% |

| Average +/- 1 std. dev (-14 to +18) | 64.1% | 2.0% | 4.3% | 9.6% |

| Bullish: +1 to + 2 std. dev (+18 to +34) | 14.9% | 1.7% | 4.4% | 8.2% |

| Very Bullish: Above 2 std. dev (Above 34) | 1.5% | 0.3% | -0.2% | -2.2% |

| All periods July 24, 1987 to December 22, 2023 | 100% | 2.1% | 4.5% | 9.4% |

Source: LPL Research, Bloomberg, AAII as of 12/22/23

Disclosures: AAII Bull-Bear spread brackets based on 10-year rolling average and one or two standard deviations above/below.

All indexes are unmanaged and cannot be invested into directly.

Past performance is no guarantee of future results.

Summary

After the recent run up in stocks, there are now many investors who head into 2024 in a bullish mood. This stretched sentiment supports our thesis that stocks will likely be up in 2024, but returns may be somewhat muted. We still expect a mild recession to occur, which may usher in some interest rate decreases from the Federal Reserve to offset some of the economic and market impact. We maintain a neutral allocation to equities and are overweight fixed income (as valuations are still attractive relative to equities amid higher yields), funded from cash (where the return profiles of short-term products are attractive, but reinvestment risk remains).

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk.

Indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

This material was prepared by LPL Financial, LLC. All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

Unless otherwise stated LPL Financial and the third party persons and firms mentioned are not affiliates of each other and make no representation with respect to each other. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

Asset Class Disclosures –

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

Bonds are subject to market and interest rate risk if sold prior to maturity.

Municipal bonds are subject and market and interest rate risk and potentially capital gains tax if sold prior to maturity. Interest income may be subject to the alternative minimum tax. Municipal bonds are federally tax-free but other state and local taxes may apply.

Preferred stock dividends are paid at the discretion of the issuing company. Preferred stocks are subject to interest rate and credit risk. They may be subject to a call features.

Alternative investments may not be suitable for all investors and involve special risks such as leveraging the investment, potential adverse market forces, regulatory changes and potentially illiquidity. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

Mortgage backed securities are subject to credit, default, prepayment, extension, market and interest rate risk.

High yield/junk bonds (grade BB or below) are below investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

Precious metal investing involves greater fluctuation and potential for losses.

The fast price swings of commodities will result in significant volatility in an investor’s holdings.

Securities and advisory services offered through LPL Financial, a registered investment advisor and broker-dealer. Member FINRA/SIPC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value

Weekly Market Performance — December 22, 2023

LPL Research’s Weekly Market Performance for the week of Dec. 18, 2023, highlights outflows of U.S. equities, December consumer confidence, and housing starts.