LPL Research explores the Santa Claus Rally seasonal period and how it correlates with future equity market performance.

Wealth Management

Will Santa Claus or the Grinch Show Up This Year?

Adam Turnquist | Chief Technical Strategist

Key Takeaways

- ‘Tis the season for the Santa Claus Rally! This historically strong seasonal period officially kicks off today and ends on the second trading day of January.

- While the Santa Claus Rally period has usually generated above-average returns during its short seven-day time window, it also correlates closely to January and following-year returns.

- When investors are on the ‘nice’ list, and Santa delivers a positive Santa Claus Rally return, the S&P 500 has generated an average forward annual return of 10.4%.

- However, when investors are on the ‘naughty’ list, and Santa delivers a negative Santa Claus Rally return, the S&P 500 has generated an average forward annual return of only 4.1%.

Today marks the first day of the Santa Claus Rally period. Yale Hirsch first discovered this unique seasonal pattern in 1972. Hirsch, creator of the Stock Trader’s Almanac, officially defined the period as the last five trading days of the year plus the first two trading days of the new year.

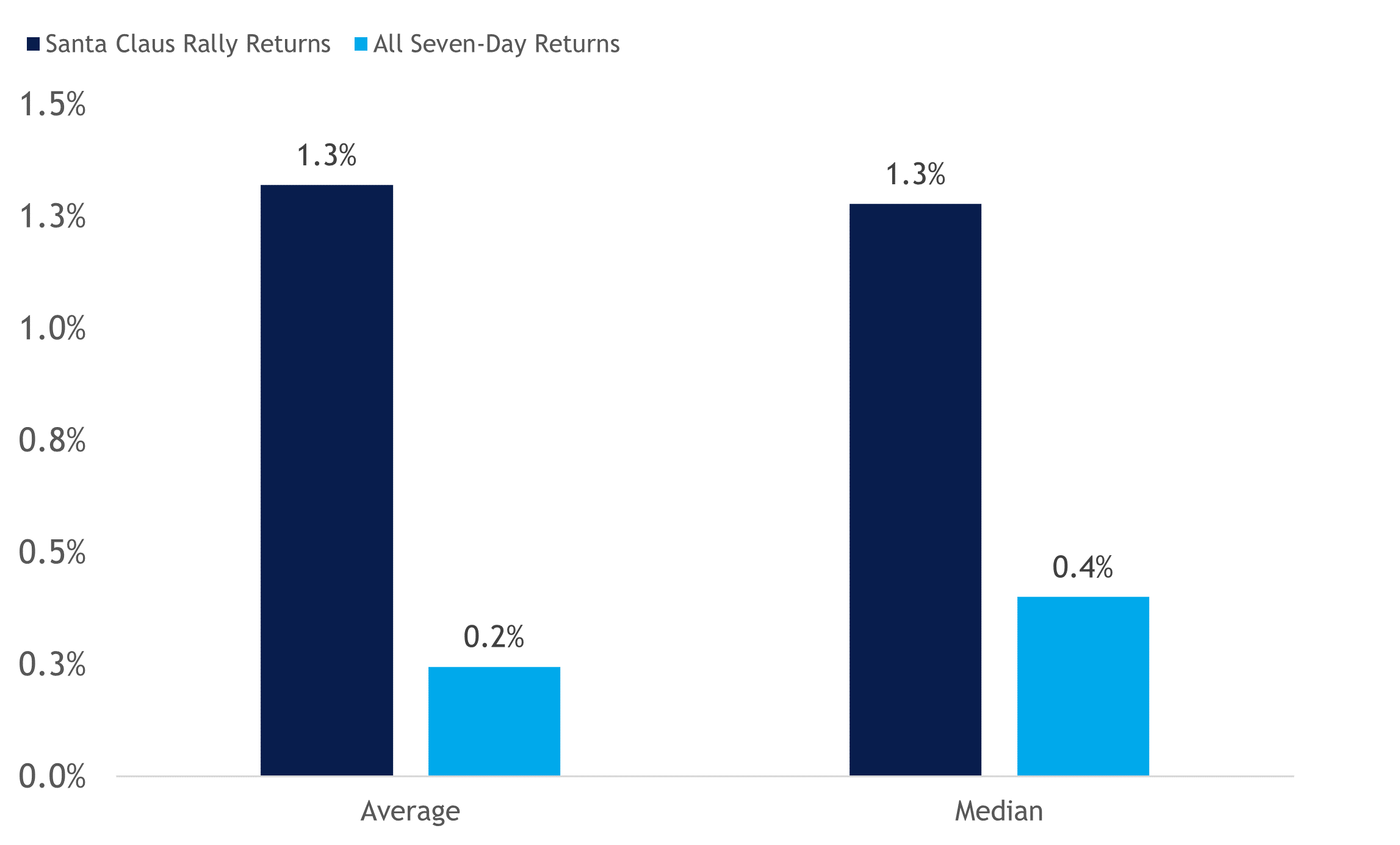

The Santa Claus Rally usually generates a lot of attention due to its historically strong market returns during such a short time frame. As highlighted in the chart below, the S&P 500 has generated average and median returns of 1.3% during the Santa Claus Rally period, compared to only 0.2% and 0.4% average and median returns for all rolling seven-day returns, respectively.

The Santa Claus Rally Historically Delivers Above-Average Gains

S&P 500 Santa Claus Rally Returns (1950–2022)

Source: LPL Research, Bloomberg 12/22/23

Disclosures: Past performance is no guarantee of future results. All indexes are unmanaged and can’t be invested in directly. The modern design of the S&P 500 stock index was first launched in 1957. Performance back to 1950 incorporates the performance of the predecessor index, the S&P 90.

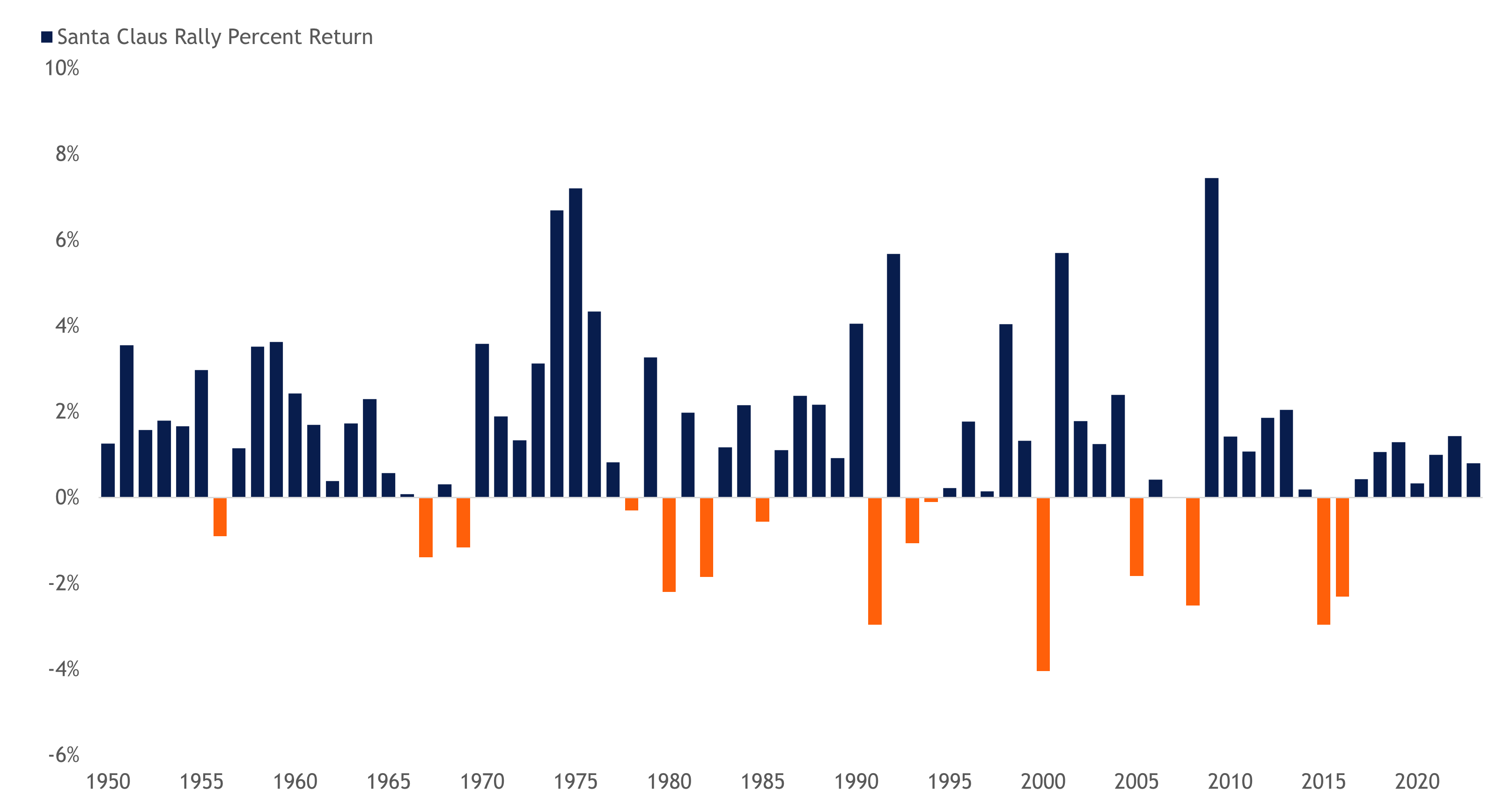

Santa is on a Hot Streak

If the S&P 500 finishes higher during this year’s Santa Claus Rally, it will mark the eighth consecutive period of positive returns. The longest streak was 10 back in the mid-1960s. However, as highlighted in the table below, positive returns during the Santa Claus Rally are relatively common, as the market has advanced 80% of the time during this period. For additional context, all rolling seven-day returns for the S&P 500 since 1950 have a positivity rate of only 58%.

S&P 500 Santa Claus Rally Returns by Year (1950–2022)

Source: LPL Research, Bloomberg 12/22/23

Disclosures: Past performance is no guarantee of future results. All indexes are unmanaged and can’t be invested in directly. The modern design of the S&P 500 stock index was first launched in 1957. Performance back to 1950 incorporates the performance of the predecessor index, the S&P 90.

The Naughty or Nice List

One of the other primary aspects of the Santa Claus Rally seasonal period is that returns during this time frame have historically correlated closely to January and subsequent year returns. As Yale Hirsch stated, “If Santa Claus should fail to call, bears may come to Broad and Wall.” As illustrated below, historical returns give merit to his maxim, as the S&P 500 has notably outperformed in January and over the following year when investors make the ‘nice’ list, with Santa delivering a positive Santa Claus Rally return.

How Stocks Perform With or Without Santa Showing Up

| Santa Shows Up | Santa No-Shows | |||||

| Average | Median | % Positive | Average | Median | % Positive | |

| January Return | 1.4% | 1.8% | 64.4% | -0.3% | -1.8% | 40.0% |

| Next Year Return | 10.4% | 12.4% | 74.1% | 4.1% | 3.0% | 66.7% |

Source: LPL Research, Bloomberg 12/22/23

Disclosures: Past performance is no guarantee of future results. All indexes are unmanaged and can’t be invested in directly. The modern design of the S&P 500 stock index was first launched in 1957. Performance back to 1950 incorporates the performance of the predecessor index, the S&P 90.

Summary

The market is entering a unique seasonal period with strong momentum coming into year-end. Based on history, a positive Santa Claus Rally this year would be a good sign for a strong January and 2024. While negative Santa Claus Rally periods have historically been associated with underwhelming market performance over the following year, LPL Research believes there are plenty of catalysts for the market to offset potentially weak seasonality. As outlined in our Outlook 2024: A Turning Point, interest rate stability, the end of the Federal Reserve’s rate-hiking campaign, falling inflation, and improving corporate profits should support equities in 2024.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk.

Indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

This material was prepared by LPL Financial, LLC. All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

Unless otherwise stated LPL Financial and the third party persons and firms mentioned are not affiliates of each other and make no representation with respect to each other. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

Asset Class Disclosures –

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

Bonds are subject to market and interest rate risk if sold prior to maturity.

Municipal bonds are subject and market and interest rate risk and potentially capital gains tax if sold prior to maturity. Interest income may be subject to the alternative minimum tax. Municipal bonds are federally tax-free but other state and local taxes may apply.

Preferred stock dividends are paid at the discretion of the issuing company. Preferred stocks are subject to interest rate and credit risk. They may be subject to a call features.

Alternative investments may not be suitable for all investors and involve special risks such as leveraging the investment, potential adverse market forces, regulatory changes and potentially illiquidity. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

Mortgage backed securities are subject to credit, default, prepayment, extension, market and interest rate risk.

High yield/junk bonds (grade BB or below) are below investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

Precious metal investing involves greater fluctuation and potential for losses.

The fast price swings of commodities will result in significant volatility in an investor’s holdings.

Securities and advisory services offered through LPL Financial, a registered investment advisor and broker-dealer. Member FINRA/SIPC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value

How Equity Factors Fared in 2023

LPL Research examines equity style factors that drove and lagged the market during a chaotic 2023.

Is This Time Truly Different?

Dr. Jeffrey Roach | Chief Economist

Market pundits often shy away from the admission that “this time is different.” But why should we be afraid of that? Markets and the economy are still adjusting to an era of higher rates, a remote labor force, and a global economy filled with political uncertainty. There are a few things that are different, and it’s important to remember investors can find opportunities amid the flux.

This LPL Research blog will share a few charts, but for more, check out the Econ Market Minute about the diverging paths among retailers.

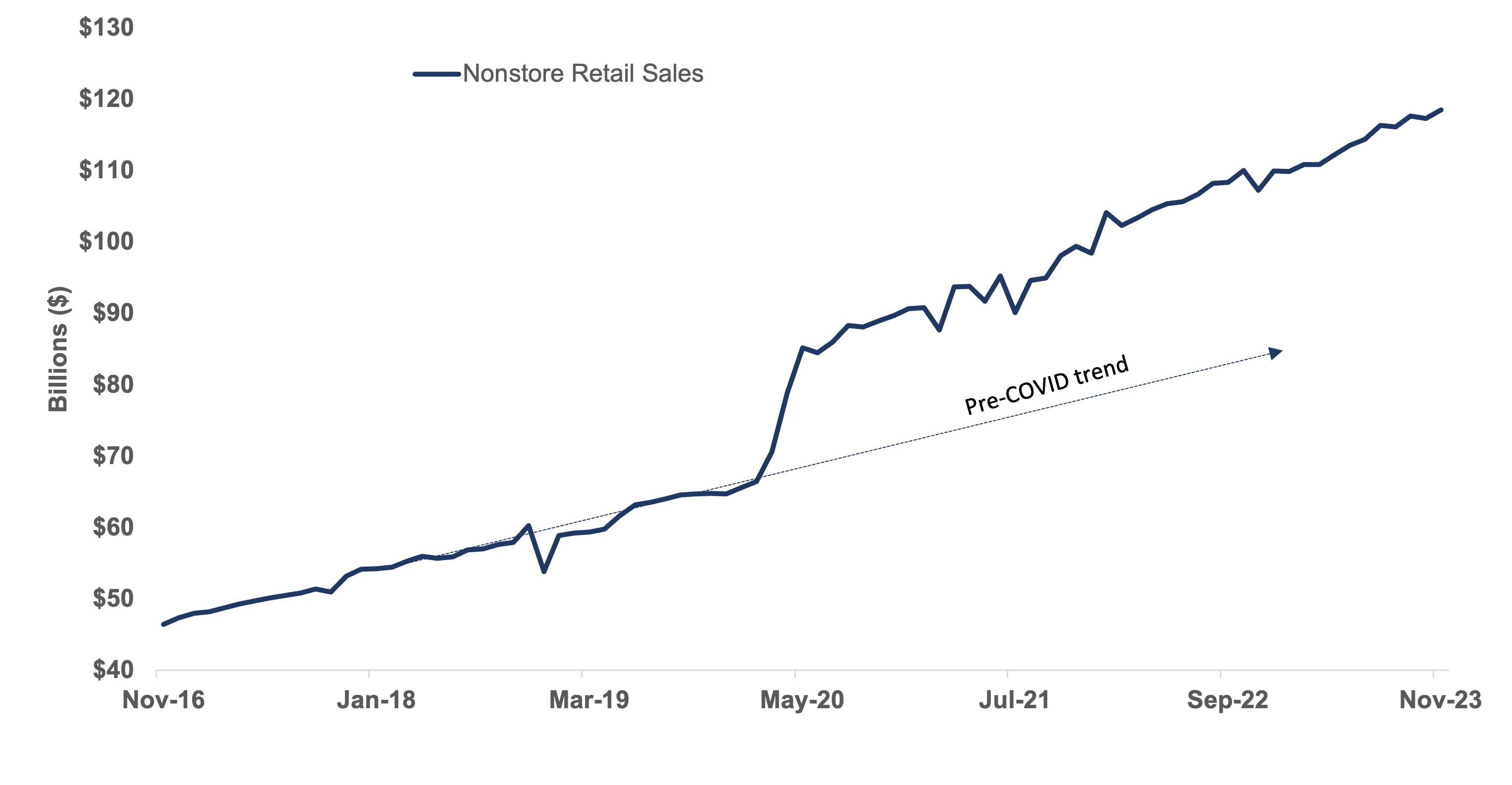

E-commerce is Gaining Greater Wallet Share

One thing different right now is post-pandemic shopping behavior. As noted in the chart below, the pandemic accelerated the use of e-commerce. Consumers shifted to online shopping, and so far, that habit seems to have stuck. Consumers are shunning department stores, instead choosing to shop online and hunt for bargains and prefer the convenience of e-commerce. This shift has ramifications for retailers working to gain wallet share.

Business Shutdowns Accelerated the Use of E-commerce — the Shift to Online Sales is Sticking

Source: LPL Research, U.S. Census Bureau 12/15/23

Disclosures: Past performance is no guarantee of future results.

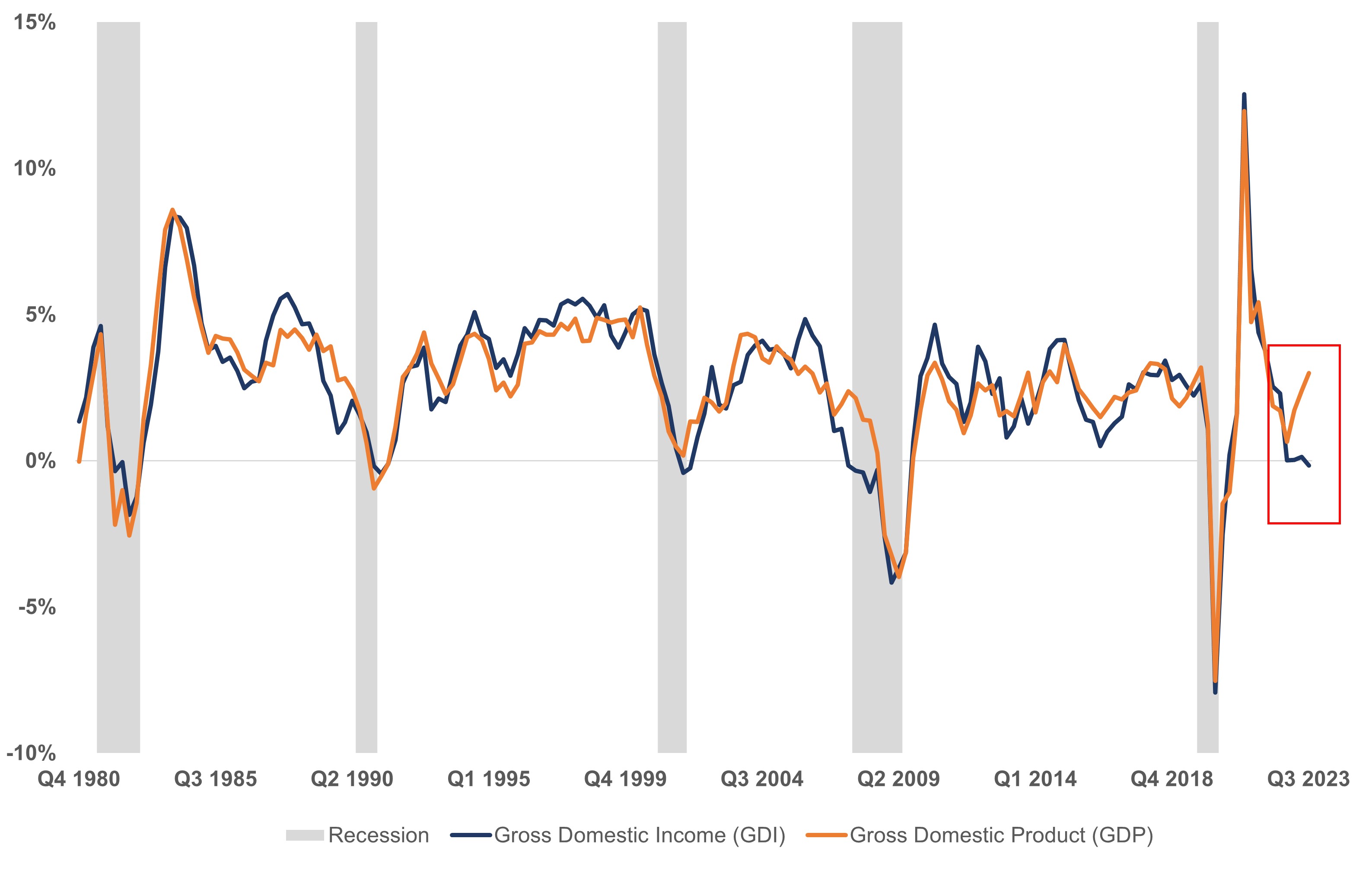

GDP Overstates Growth

Another part of the economy that’s different this time around is Gross Domestic Income (GDI). The last time we had such a gap between these GDI and Gross Domestic Product (GDP) measures was 2007, when the economy was about to experience a recession. GDP and GDI are corresponding measures of the economy but should match. GDP is all the spending by businesses, consumers, and the government, whereas GDI is the aggregate wages, salaries, corporate profits, and other incomes generated by economic activity.

The Economy is Not as Strong as it Seems — as GDI Indicates

Source: LPL Research, U.S. Bureau of Economic Analysis 12/20/23

Disclosures: Past performance is no guarantee of future results.

As investors set expectations for the new year, it’s important to take note of the opportunities available.

A Catalyst for Homebuilders

I mentioned a relatively large percentage of remote workers. This new regime has ramifications for the housing market. Typically, investors would think the residential real estate market is one of the most interest rate sensitive areas of the economy. But when households are less constrained by the job market, when homebuilders can buy down rates for prospective buyers, and when inventories of existing homes are at near-cycle lows, investors will likely witness a catalyst for homebuilders.

The low inventory of existing homes for sale was a catalyst for homebuilders in recent months. Housing starts in November were much higher than in 2019 as homebuilders got creative with buying down mortgage rates for buyers. We are noticing strength in both single-family and multi-family activity as homebuilders take advantage of the low supply of existing homes on the market. Most of the housing starts were in the South as hybrid work continues to be a boon for households seeking a lower cost of living. Investors have clearly rewarded homebuilders, as low inventory of existing homes on the market has created an opportunity for new construction. Falling mortgage rates also helped ignite demand.

Summary

Investors should expect to find opportunities despite the uncertainty about the upcoming year. Political tensions remain elevated around the globe, consumers still have rising debt burdens, and governments are saddled with debt. Yet, opportunities remain, and savvy investors will find them.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk.

Indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

This material was prepared by LPL Financial, LLC. All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

Unless otherwise stated LPL Financial and the third party persons and firms mentioned are not affiliates of each other and make no representation with respect to each other. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

Asset Class Disclosures –

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

Bonds are subject to market and interest rate risk if sold prior to maturity.

Municipal bonds are subject and market and interest rate risk and potentially capital gains tax if sold prior to maturity. Interest income may be subject to the alternative minimum tax. Municipal bonds are federally tax-free but other state and local taxes may apply.

Preferred stock dividends are paid at the discretion of the issuing company. Preferred stocks are subject to interest rate and credit risk. They may be subject to a call features.

Alternative investments may not be suitable for all investors and involve special risks such as leveraging the investment, potential adverse market forces, regulatory changes and potentially illiquidity. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

Mortgage backed securities are subject to credit, default, prepayment, extension, market and interest rate risk.

High yield/junk bonds (grade BB or below) are below investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

Precious metal investing involves greater fluctuation and potential for losses.

The fast price swings of commodities will result in significant volatility in an investor’s holdings.

Securities and advisory services offered through LPL Financial, a registered investment advisor and broker-dealer. Member FINRA/SIPC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value

For Public Use – Tracking: 519258

The More Things Changed, the More They Stayed the Same

LPL Financial Research looks at the current set-up for fixed income, which isn’t very different from what it was to start the year.

Dow Rallies from Correction to Record Highs in 32 Trading Days

LPL Research explores the recent rally on the Dow Jones Industrial Average and how the index has historically performed after registering record highs.

Weekly Market Performance — December 15, 2023

LPL Research’s Weekly Market Performance for the week of Dec. 11, 2023, recaps another strong week for equities, a rebound in oil, and the FOMC meeting.

Dow Rallies to Record-Highs

Posted by Adam Turnquist, CMT, VP Chief Technical Strategist

Friday, December 15, 2023

Key Takeaways:

- The Dow Jones Industrial Average (INDU) has gone from correction to record highs in only 32 trading days. Broadening participation predicated on falling interest rates and signs of a soft-landing scenario have underpinned the recovery.

- What happens after a record high? Over the last 100 years, and filtering for record highs occurring at least three months apart, upside momentum has historically continued. The INDU has generated an average 12-month forward return of 11.1% after posting a new record high, with 71% of occurrences producing positive results.

- And with the INDU already at record highs, all eyes are now on the Dow Jones Transportation Average (TRAN) to confirm the breakout, per Dow Theory.

- LPL Research views the INDU’s recent record-high rally as another piece of evidence supporting the health and sustainability of the current bull market.

It only took 489 trading days, but the INDU climbed back into record-high territory this week. Broadening participation in the equity market recovery has lifted the index 15% above its recent October low and above the prior January 4, 2022 record high of 36,800.

While the INDU has become obsolete as a benchmark for portfolio managers due to its price-weighted methodology, its long history and blue-chip components still make it a relevant index to watch. Furthermore, the INDU is a little more balanced with sector weights than the tech-heavy S&P 500, as financials, health care, technology, and industrials each hold around a 15–20% weight within the index.

The INDU is also a key component of Dow Theory — a technical framework dating back to the early 1900s that is generally used to define market trends. Charles Dow, co-founder and editor of the Wall Street Journal, is credited with the original theory.

One of the tenets of Dow Theory is that the averages must confirm each other, simply meaning breakouts and breakdowns in the INDU and TRAN should happen in concert. Conceptually, Charles Dow observed in the late 1800s that raw materials would need to be transported via railroads before economic expansion could begin. Subsequently, robust rail activity would typically portend favorable economic conditions for industrial companies.

With the INDU already at record highs, all eyes are now on the TRAN to check the box for a Dow Theory buy signal (the averages must confirm each other).

What Happens After a Record High?

While record highs are great, the next question, of course, is what happens next, especially for those investors who may have missed the rally. Using history as a guide, we found that over the last 100 years, upside momentum continued after the INDU registered a meaningful record high, defined by record highs occurring at least three months apart. As illustrated in the table below, the INDU has generated an average 12-month forward return of 11.1% after posting a new record high, with 71% of occurrences yielding positive results.

Summary

While the INDU’s price-weighting methodology limits its use as a portfolio benchmark, the index’s long history and blue-chip components still make it a relevant benchmark to watch. LPL Research views the INDU’s recent record-high rally as another piece of evidence supporting the health and sustainability of the current bull market. A breakout on the TRAN index would further support the bull case and check the box for a Dow Theory buy signal. Finally, history suggests that record highs are typically followed by continued upward momentum. Or as veteran technician Stan Weinstein said, “Whenever a breakout occurs with a stock moving into virgin territory (it’s never traded there before), this is the most bullish situation you can buy. Think about it. There isn’t one person who is long and has a loss.”

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments. For more information on the risks associated with the strategies and product types discussed please visit https://lplresearch.com/Risks

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Unless otherwise stated LPL Financial and the third party persons and firms mentioned are not affiliates of each other and make no representation with respect to each other. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

Securities and advisory services offered through LPL Financial, a registered investment advisor and broker-dealer. Member FINRA/SIPC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value

November Fund Flows Recap—Shift Toward Passive Continues

Posted by George Smith, CFA, CAIA, CIPM, Portfolio Strategist

Thursday, December 14, 2023

Additional content provided by Kent Cullinane, Analyst

With November behind us, we decided to conduct a deeper dive into fund flows, also known as asset flows or simply “flows,” over the month. Flows measure the net movement of cash into and out of investment vehicles, such as mutual funds and exchange-traded funds (ETF). Investors analyze flows to gain insight on investor demand and sentiment surrounding asset classes, sectors, and other classifications of markets.

In today’s analysis, we will be examining the flows across various asset classes, followed by a closer examination of individual Morningstar categories. Additionally, we will explore the disparities in flows between active and passive investments.

Asset Class Flows

During the one-month period ending on November 30, 2023, U.S. equities experienced the highest net inflow among asset classes, with a flow of approximately $21.6 billion (represented by the light blue line). However, you’ll notice that the inflow into U.S. equity ETFs (orange) outweighed the outflow out of U.S. equity mutual funds (dark blue), highlighting investor appetite for passive U.S. equity investments. Not far behind U.S. equities are taxable bonds, which saw a $21.3 billion net flow, again showing ETF inflows meaningfully outweighing mutual fund outflows. It is worth noting that money market products were excluded from the below chart. If money market flows were included, it would significantly outpace all other asset classes in terms of flows, with a net $184.6 billion monthly inflow—not surprising given the yields on short-term interest rates.

Flows for the year-to-date period are not too dissimilar from the trailing one-month period, as ETFs continued to gather assets in U.S. equities and taxable bonds. While ETFs recorded a net inflow in U.S. equities, the outflow from U.S. equity mutual funds meaningfully outweighed the ETF inflow, resulting in a net negative flow for U.S. equities for the calendar year. In taxable bonds, mutual funds experienced a net inflow, in addition to the ETF inflow, resulting in taxable bonds seeing the largest net flow across asset classes year to date at $199 billion.

Morningstar Category Flows

When looking at Morningstar categories, large blends experienced the largest net inflow over the trailing one-month period, nearly $23.4 billion. Following large blend was the high-yield bond category, experiencing an inflow of $12.8 billion. The next three categories sequentially—intermediate-core bond, corporate bond, and long government bond—highlight investor sentiment towards longer-duration asset classes, with combined inflows of $16.7 billion. Looking at the other end of the spectrum, ultrashort bonds and short-term bonds saw the largest outflows of $17.9 billion and $15.9 billion, respectively, further emphasizing the move out of short duration assets and into long.

The year-to-date period appears similar, with intermediate-core bonds gathering the most flows ($110.2 billion) followed by large blend ($95.5 billion) and long government ($51.2 billion). Another notable category was derivative income, which gained $22.4 billion in flows. Derivative income strategies have boomed in popularity given their ability to generate significant income through the utilization of a covered call-writing strategy, while also participating in the markets, albeit at a lower beta.

When comparing the latest LPL Research Strategic and Tactical Asset Allocation Committee (STAAC) views with the November (and year-to-date) flows data, there are a number of similarities. The top asset class by inflows is U.S. equities, with large cap blended equities outpacing their mid and small cap peers. The STAAC maintains an overweight to large cap equities over mid and small-caps, given continued economic uncertainty and positive technical trends in the asset class. Additionally, November flows highlight investor sentiment for higher-duration asset classes. While the STAAC maintains neutral duration, the Committee favors fixed income broadly over cash, as the risk-return trade-off is attractive relative to history.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments. For more information on the risks associated with the strategies and product types discussed please visit https://lplresearch.com/Risks

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Unless otherwise stated LPL Financial and the third party persons and firms mentioned are not affiliates of each other and make no representation with respect to each other. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

Securities and advisory services offered through LPL Financial, a registered investment advisor and broker-dealer. Member FINRA/SIPC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value

November Fund Flows Recap — The Shift Toward Passive Continues

LPL Research explores November fund flows data and investor sentiment across asset classes.